Causes of Business Failure: Early warning signs to look out for

[fusion_builder_container hundred_percent=”no” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” status=”published” publish_date=”” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

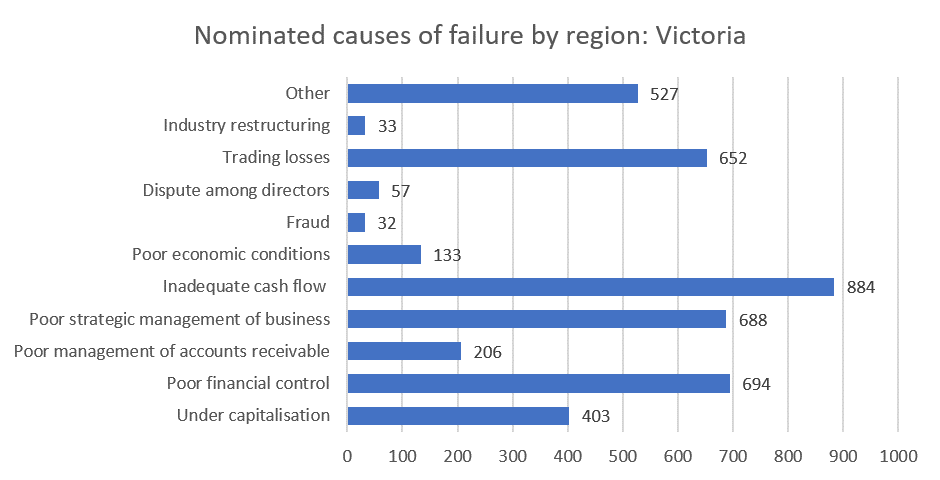

Released in December 2019 and summarised in the below chart, the Australian Securities and Investments Commission (“ASIC”) insolvency statistics disclosed various causes of business failure in Victoria as nominated in the external administrators’ reports.

Source: Australian Securities and Investments Commission, Australian Insolvency Statistics (1 July 2018 – 30 June 2019), 3.1 – External administrators’ reports, Table 3.1.3.2: Nominated causes of failure by region

Based on ASIC’s statistics, following are some of the key causes of business failure which small to medium businesses should look out for and seek expert assistance and advice if these warning signs appear.

Trading losses

Trading losses is probably the most common warning sign which points towards the financial difficulties of a company and its business.

However, it is important to understand the underlying reasons for a trading loss or a series of trading losses. If the business is its infancy a trading loss in itself should not be a cause for concern provided there is projected growth in the coming periods which can absorb the initial loss.

Therefore, it is important to frequently undertake an assessment of the financial position of the business and have a complete understanding of its current and projected financial position.

Inadequate cash flow

Cash flow shortage can happen abruptly, particularly for small to medium businesses whose sales revenue can fluctuate from time to time due to an unforeseen event. For instance, loss of a key customer could knock an otherwise stable business of its rails. In such scenario, the absence of an adequate buffer of liquid assets may prove fatal.

Therefore, when your business is doing well and generating healthy profits, it is vital to ensure that there are enough cash reserves and other liquid assets available. Moreover, you should stay well-informed of your company’s financial performance, diligently record and analyse past cash flow and update financial forecasts so that you are prepared for routine and unanticipated expenses alike.

Poor strategic management of business

Strategic management refers to the high-level planning and setting of objectives and then working to realise those objectives. Imagine it as a roadmap that shows how to achieve your vision for your business.

Identification of goals provides a sense of purpose for the employees and the company. It also facilitates greater communication across the business. Over the long run, strategic management is aimed at enabling the company to increase revenue and business growth, and ultimately establish and hold onto a competitive advantage.

Strategic management also includes business agility to ensure that your business can effectively and efficiently respond to change. For example, if the business overheads are constantly high then cost cutting measures must be considered and implemented immediately in order to minimise the adverse impact on the bottom line of the business.

Again, it is vital that you maintain a constant oversight of the financial position and seek help from your accountants and other business advisors.

Poor financial control (including lack of records)

Poor financial control including lack of records is another warning sign, particularly when the business is growing quickly. During periods of rapid growth, you are susceptible to focusing on business development at the expense of internal controls and record keeping.

Without effective and adequate financial control, you cannot identify the areas of concern and therefore cannot address the underlying issues.

An effective financial control system is absolutely crucial to the resource management and operational efficacy of business. Information and insights collected by financial control provide you with a screening mechanism that promptly detects specific problems and allows the implementation of pre-emptive measures before they escalate.

Undercapitalisation

Whilst a stable line of credit is indispensable for a business of any size or trade, keeping on top of debt repayments is crucial to a business’s wellbeing as borrowing excessively exposes the business to the risk of undercapitalisation.

Undercapitalization means that a company does not have sufficient capital to conduct normal business operations and to meet its liabilities as and when they fall due. Often undercapitalisation happens because the company is not generating enough profit to service its debt and is also unable to raise further capital by accessing financing such as debt or equity.

To prevent undercapitalisation, you should minimise the amount of unnecessary debt the business takes on, especially when profit is limited. Also, it is important to monitor the financial position and cash flow of your business. Provided undercapitalization is picked up early enough and your company has sufficient liquid assets to buy some time, its financial wellbeing can be restored by refinancing, cost-cutting or restructuring.

The team at Collins Wentworth are experienced in business financial matters. If you have concerns about the financial position of your business and wish to know more about how we can assist you, contact us today.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]